The Metropolitan Area Employment and Unemployment data for July 2022 are scheduled to be released on August 31 2022 at 1000 AM. Similar to independent contractors statutory employees may deduct business expense from W-2 earnings.

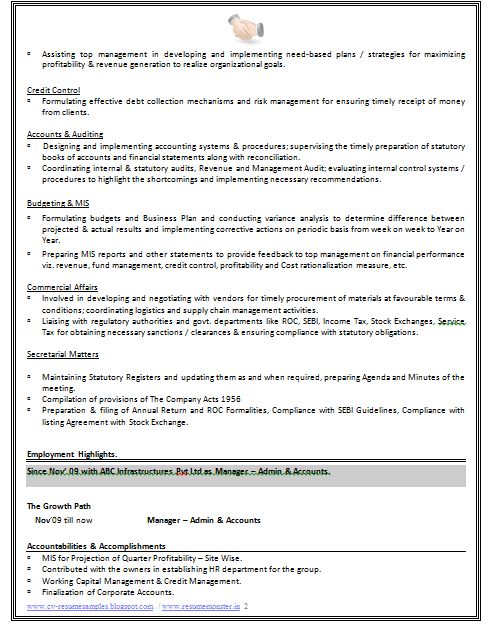

Accountant Resume 2 Accountant Resume Risk Management Resume

Direct sellers licensed real estate agents and certain companion sitters.

. These employees are statutory employees because under the common law test they are an independent contractor by definition but they can be treated. But just like employed individuals statutory employees only have to pay half of their Medicare and Social Security taxes since their employer is paying the other half. Statutory employees will need to receive a W-2 form with the box ticked showing that they are a statutory employee.

An employee who is allowed to deduct expenses on Schedule C Business Income or Loss is a statutory employee although he or she still receives a W-2 from an employer. Pay FICA tax through their employer and so do not pay self-employment tax. Statutory employees report their wages income and allowable expenses on Schedule C.

There are three categories of statutory nonemployees. If youre not familiar with creating a Schedule C in TaxSlayer Pro see here for instructions. Direct sellers and licensed real estate agents are treated as self-employed for all Federal tax purposes including income and employment taxes if.

Despite this they must report expenses income and wage. Statutory Income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given under the Income Tax Act. COMPUTATION OF STATUTORY INCOME FROM EMPLOYMENT FOR YEAR OF ASSESSMENT 2XXX RM RM Section.

In conclusion a statutory employee is one who controls the work load and how much is to be done with little to no input from the employer. The employer should indicate on the workers Form W-2 whether the worker is classified as a statutory employee in box 13. Limited Liability Entities DE 231LLC for more detailed.

Refer to Information Sheet. A statutory employee is an independent contractor under American common law who is treated as an employee. Statutory Income is also reffered to as Take Home Pay as it is the amount of money you take home after all deductions.

Theyll then report their income and expenses on their Schedule C just as a. That is treated as a corporation for federal income tax purposes. If workers are independent contractors under the common law rules such workers may nevertheless be treated as employees by statute statutory employees for certain employment tax purposes if they fall within any one of the following four categories and meet the three conditions described under Social Security and Medicare.

With this box checked the income from Box 1 will not show as wages in the Form 1040 Income menu Enter the W-2 Box 1 income in Schedule C Profit or Loss From Business. A statutory employee is able to deduct their business expenses against their income on Schedule C just like independent contractors. For any statutory employee the employer must pay all of of the required payroll taxes including Social Security and Medicare to the Internal Revenue Service.

CUIC a statutory employee includes any member of an LLC. Gross income of an employee doesnt include amounts paid or incurred by the employer for dependent care assistance provided to such employee if the assistance is furnished pursuant to a. The statutory nontaxable benefits provided to key employees exceed 25 percent of the aggregate of such benefits provided for all employees under the plan.

Contacting the Department of Unemployment Assistance to fulfill obligations for state employment security taxes. As a Corporation for Federal Income Tax Purposes as Statutory Employees Effective January 1 2011 under Section 621f of the. Enter the Form W-2 in its menu ensuring Statutory Employee is checked in Box 13.

The State Employment and Unemployment data for July 2022 are scheduled to be released on August 19 2022 at 1000 AM. View COMPUTATION OF STATUTORY INCOME FROM EMPLOYMENT 1pdf from AC TAX217 at MARA University of Technology. A statutory employee is a special type of worker whose wages are not subject to federal income tax withholding but are subject to FICA Social Security and Medicare and FUTA unemployment taxes.

Jamaica Tax - Statutory Income. Substantially all payments for their services as direct. For unemployment insurance information call 617 626-5075.

Even though a statutory employee is not a. The amount of federal and Massachusetts income tax withheld for the prior year. The total Social Security and Medicare taxes withheld.

Tashapb I Will File Your Uk Company Accounts And Tax Return For 105 On Fiverr Com Tax Consulting Corporate Accounting Filing Taxes

Link Aadhaar With Epf Uan Account Online Offline Process Accounting Online Accounting Bank Account

Restaurant Management Contract Template Contract Agreement Contract Template Restaurant Management

Pin By Weivy Beiby On My Saves Security Tips How To Plan Employment

Welfare Spending In The Uk Income Support Carers Allowance Pie Graph

Good Cv Resume Sample For Experienced Chartered Accountant 2 Cv Resume Sample Accountant Resume Good Cv

Printable Sample Employment Contract Sample Form Contract Template Free Basic Templates Employment

Iict Networkingtraining Hardware Iict Is The No 1 Hardware And Networking Training Institute In Chennai Desktop Support Training Center Supportive

Step 3 Your Home Supportive Mortgage Lender

Law Student Resume Sample Resumecompanion Com Law School Life Law School Inspiration Law School Prep

The Budget Process Flow Chart House Budgeting Budgeting May House

Mariels I Will Help You Process An Irs Tax Letter Notices Or Audits For 20 On Fiverr Com Irs Taxes Tax Consulting Business Tax

Tax Calculation Spreadsheet Excel Formula Spreadsheet Spreadsheet Template

Example Of Resume Page 2 Resume Examples Budgeting Resume

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Hmrc P60 Digital Copy National Insurance Number Income Tax Details Document Templates

1040 2020 Internal Revenue Service Tax Forms Irs Tax Forms Standard Deduction

Hr Generalist Training In Noida Human Resources Career Human Resources Hr Jobs